All Categories

Featured

Table of Contents

- – Esteemed Accredited Investor Opportunities

- – Unparalleled Accredited Investor Secured Inves...

- – High-Performance Accredited Investor Alternat...

- – Dependable Accredited Investor Syndication Deals

- – Specialist Accredited Investor Property Inve...

- – Accredited Investor Secured Investment Oppor...

- – Strategic Exclusive Deals For Accredited Inv...

The policies for accredited investors differ among jurisdictions. In the U.S, the interpretation of a recognized investor is placed forth by the SEC in Guideline 501 of Regulation D. To be a recognized investor, a person should have an annual income going beyond $200,000 ($300,000 for joint earnings) for the last 2 years with the expectation of earning the same or a greater earnings in the present year.

This quantity can not consist of a key house., executive officers, or directors of a business that is releasing non listed protections.

Esteemed Accredited Investor Opportunities

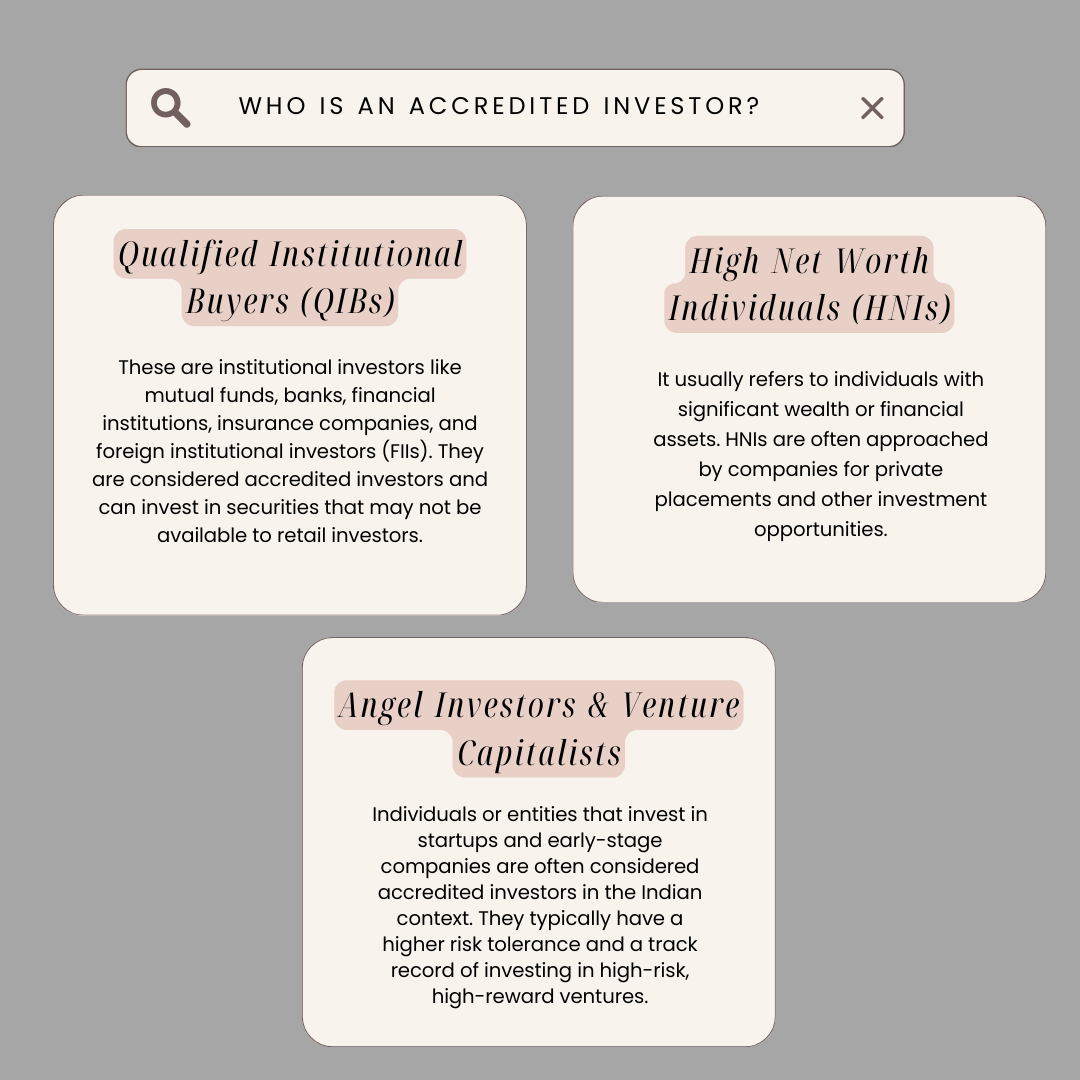

If an entity consists of equity proprietors who are recognized financiers, the entity itself is a certified capitalist. A company can not be created with the single purpose of acquiring certain safeties. An individual can certify as an approved investor by demonstrating enough education and learning or work experience in the monetary sector

Individuals who want to be accredited investors don't relate to the SEC for the designation. Instead, it is the responsibility of the firm supplying an exclusive placement to ensure that all of those approached are certified capitalists. Individuals or parties who wish to be certified investors can approach the issuer of the non listed securities.

For instance, expect there is a private whose earnings was $150,000 for the last three years. They reported a main home value of $1 million (with a home mortgage of $200,000), an automobile worth $100,000 (with an outstanding financing of $50,000), a 401(k) account with $500,000, and a financial savings account with $450,000.

Total assets is calculated as possessions minus obligations. This individual's internet worth is precisely $1 million. This includes a computation of their properties (aside from their key residence) of $1,050,000 ($100,000 + $500,000 + $450,000) much less an auto loan equaling $50,000. Since they meet the total assets requirement, they qualify to be a recognized investor.

Unparalleled Accredited Investor Secured Investment Opportunities for Accredited Investors

There are a couple of less typical certifications, such as managing a count on with even more than $5 million in possessions. Under government safeties regulations, only those who are recognized investors might join specific protections offerings. These might consist of shares in personal positionings, structured items, and private equity or hedge funds, among others.

The regulators intend to be certain that participants in these extremely risky and complex investments can look after themselves and evaluate the risks in the absence of government protection. The accredited investor policies are created to shield potential capitalists with minimal monetary expertise from risky endeavors and losses they might be sick outfitted to stand up to.

Approved capitalists satisfy certifications and expert standards to accessibility special financial investment possibilities. Accredited capitalists have to satisfy earnings and net well worth demands, unlike non-accredited people, and can invest without limitations.

High-Performance Accredited Investor Alternative Asset Investments with Maximum Gains

Some essential adjustments made in 2020 by the SEC consist of:. Consisting of the Series 7 Collection 65, and Series 82 licenses or various other qualifications that show financial proficiency. This adjustment recognizes that these entity types are often made use of for making investments. This change recognizes the knowledge that these workers create.

This adjustment make up the impacts of rising cost of living with time. These modifications increase the accredited financier swimming pool by roughly 64 million Americans. This broader gain access to offers more opportunities for investors, yet additionally raises potential risks as less monetarily sophisticated, financiers can participate. Businesses using exclusive offerings might take advantage of a bigger pool of possible capitalists.

One major advantage is the possibility to purchase placements and hedge funds. These financial investment alternatives are unique to accredited capitalists and establishments that qualify as an approved, per SEC guidelines. Private positionings allow business to protect funds without browsing the IPO procedure and regulative documentation needed for offerings. This provides certified investors the opportunity to buy arising firms at a phase prior to they take into consideration going public.

Dependable Accredited Investor Syndication Deals

They are deemed financial investments and come only, to certified clients. In enhancement to well-known firms, qualified financiers can select to purchase start-ups and up-and-coming endeavors. This provides them income tax return and the chance to get in at an earlier phase and potentially reap rewards if the company prospers.

For investors open to the threats involved, backing start-ups can lead to gains (venture capital for accredited investors). A number of today's technology firms such as Facebook, Uber and Airbnb originated as early-stage startups sustained by recognized angel capitalists. Advanced financiers have the possibility to discover financial investment choices that might generate more revenues than what public markets provide

Specialist Accredited Investor Property Investment Deals for High-Yield Investments

Returns are not guaranteed, diversification and profile improvement choices are increased for capitalists. By expanding their profiles via these expanded investment methods recognized investors can improve their approaches and potentially achieve superior long-term returns with proper risk monitoring. Experienced investors frequently encounter investment options that may not be quickly readily available to the general financier.

Financial investment choices and protections offered to accredited capitalists generally entail greater dangers. As an example, exclusive equity, financial backing and bush funds commonly concentrate on spending in possessions that carry risk however can be liquidated easily for the opportunity of greater returns on those dangerous investments. Looking into prior to investing is critical these in situations.

Lock up periods prevent investors from withdrawing funds for even more months and years on end. Investors may battle to accurately value private possessions.

Accredited Investor Secured Investment Opportunities

This change may extend accredited capitalist condition to a series of individuals. Updating the income and property criteria for rising cost of living to ensure they mirror changes as time progresses. The present thresholds have actually remained fixed considering that 1982. Allowing partners in fully commited partnerships to integrate their sources for common eligibility as certified capitalists.

Making it possible for individuals with certain specialist certifications, such as Collection 7 or CFA, to qualify as certified financiers. This would certainly acknowledge economic class. Developing added demands such as evidence of monetary literacy or effectively completing an accredited investor exam. This might make certain financiers recognize the dangers. Limiting or getting rid of the key residence from the total assets calculation to minimize potentially inflated assessments of riches.

On the other hand, it might also cause seasoned financiers thinking too much risks that may not appropriate for them. So, safeguards might be required. Existing accredited financiers may encounter increased competitors for the very best investment chances if the swimming pool expands. Firms elevating funds may take advantage of an expanded accredited financier base to attract from.

Strategic Exclusive Deals For Accredited Investors for Financial Growth

Those who are currently taken into consideration recognized investors should stay updated on any kind of alterations to the requirements and policies. Businesses looking for certified investors must remain vigilant about these updates to guarantee they are attracting the appropriate target market of capitalists.

Table of Contents

- – Esteemed Accredited Investor Opportunities

- – Unparalleled Accredited Investor Secured Inves...

- – High-Performance Accredited Investor Alternat...

- – Dependable Accredited Investor Syndication Deals

- – Specialist Accredited Investor Property Inve...

- – Accredited Investor Secured Investment Oppor...

- – Strategic Exclusive Deals For Accredited Inv...

Latest Posts

House For Back Taxes

Tax Lien Investing In Canada

Tax Liens Gov

More

Latest Posts

House For Back Taxes

Tax Lien Investing In Canada

Tax Liens Gov