All Categories

Featured

Table of Contents

- – Exceptional Accredited Investor Platforms for ...

- – Reliable Accredited Investor Opportunities

- – Best-In-Class Exclusive Deals For Accredited ...

- – Exceptional Accredited Investor Wealth-buildi...

- – Five-Star Accredited Investor High Return In...

- – Top Investment Platforms For Accredited Inve...

- – Innovative Real Estate Investments For Accre...

The regulations for recognized capitalists vary among jurisdictions. In the U.S, the meaning of an accredited investor is placed forth by the SEC in Rule 501 of Law D. To be an accredited investor, an individual must have a yearly revenue exceeding $200,000 ($300,000 for joint earnings) for the last 2 years with the expectation of earning the exact same or a greater earnings in the current year.

This quantity can not consist of a main house., executive officers, or directors of a firm that is issuing unregistered safety and securities.

Exceptional Accredited Investor Platforms for Accredited Wealth Opportunities

If an entity consists of equity proprietors that are recognized financiers, the entity itself is an accredited investor. However, an organization can not be formed with the sole purpose of acquiring specific protections - investment platforms for accredited investors. An individual can qualify as a certified financier by demonstrating sufficient education or work experience in the monetary industry

Individuals that wish to be certified investors don't relate to the SEC for the classification. Rather, it is the duty of the company supplying a private placement to ensure that all of those approached are approved capitalists. Individuals or celebrations that wish to be recognized capitalists can come close to the provider of the non listed protections.

Mean there is a specific whose revenue was $150,000 for the last three years. They reported a key house worth of $1 million (with a home mortgage of $200,000), an auto worth $100,000 (with an exceptional financing of $50,000), a 401(k) account with $500,000, and a financial savings account with $450,000.

This person's web well worth is specifically $1 million. Considering that they fulfill the web worth requirement, they qualify to be a recognized financier.

Reliable Accredited Investor Opportunities

There are a couple of less common credentials, such as taking care of a trust with more than $5 million in assets. Under federal securities legislations, only those that are approved investors may join specific safeties offerings. These might consist of shares in personal positionings, structured items, and personal equity or bush funds, to name a few.

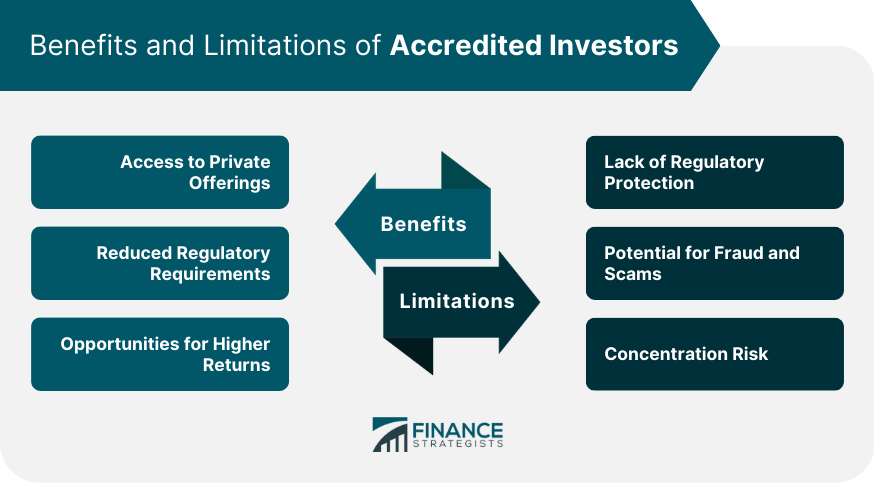

The regulatory authorities intend to be particular that individuals in these extremely risky and complicated financial investments can take care of themselves and judge the risks in the absence of federal government defense. The certified investor rules are designed to shield possible capitalists with minimal financial expertise from adventures and losses they might be ill equipped to stand up to.

Approved capitalists meet credentials and expert criteria to accessibility unique investment possibilities. Designated by the United State Securities and Exchange Payment (SEC), they acquire entrance to high-return options such as hedge funds, equity capital, and personal equity. These financial investments bypass full SEC registration but bring greater threats. Recognized financiers have to satisfy revenue and total assets needs, unlike non-accredited people, and can spend without limitations.

Best-In-Class Exclusive Deals For Accredited Investors with High-Yield Investments

Some vital adjustments made in 2020 by the SEC consist of:. Including the Series 7 Collection 65, and Series 82 licenses or various other qualifications that show economic competence. This adjustment identifies that these entity types are typically used for making financial investments. This change recognizes the know-how that these employees develop.

This modification represent the impacts of inflation gradually. These modifications expand the accredited capitalist swimming pool by about 64 million Americans. This wider access gives much more possibilities for financiers, but additionally raises possible risks as less monetarily sophisticated, capitalists can get involved. Services using private offerings might take advantage of a larger pool of potential investors.

These investment choices are unique to certified capitalists and establishments that qualify as an accredited, per SEC policies. This provides recognized financiers the chance to spend in emerging business at a phase prior to they take into consideration going public.

Exceptional Accredited Investor Wealth-building Opportunities for Accredited Wealth Opportunities

They are viewed as investments and are available only, to certified clients. In enhancement to well-known companies, qualified investors can pick to purchase start-ups and promising endeavors. This uses them tax obligation returns and the opportunity to go into at an earlier stage and possibly reap rewards if the company prospers.

Nevertheless, for capitalists open to the risks involved, backing start-ups can lead to gains. Numerous of today's technology firms such as Facebook, Uber and Airbnb originated as early-stage startups supported by recognized angel capitalists. Innovative financiers have the chance to check out investment alternatives that may yield a lot more earnings than what public markets supply

Five-Star Accredited Investor High Return Investments

Returns are not guaranteed, diversification and profile improvement choices are expanded for investors. By diversifying their portfolios with these expanded financial investment methods certified capitalists can enhance their strategies and possibly accomplish superior long-term returns with proper risk monitoring. Seasoned capitalists frequently encounter investment options that might not be quickly available to the basic financier.

Investment choices and securities supplied to recognized capitalists generally entail greater threats. Personal equity, venture capital and bush funds frequently concentrate on investing in properties that bring threat but can be sold off easily for the possibility of higher returns on those high-risk financial investments. Investigating prior to spending is crucial these in circumstances.

Lock up durations protect against financiers from taking out funds for more months and years on end. Capitalists might battle to accurately value personal assets.

Top Investment Platforms For Accredited Investors

This adjustment may prolong accredited investor condition to a range of individuals. Allowing companions in dedicated connections to incorporate their sources for common eligibility as certified financiers.

Enabling people with specific specialist qualifications, such as Series 7 or CFA, to qualify as recognized financiers. This would acknowledge economic elegance. Developing extra needs such as proof of financial proficiency or successfully completing a certified financier exam. This could ensure financiers understand the risks. Limiting or getting rid of the key house from the total assets computation to reduce possibly filled with air assessments of wealth.

On the various other hand, it could also lead to experienced capitalists presuming too much risks that may not be ideal for them. So, safeguards might be needed. Existing accredited financiers might deal with boosted competition for the ideal financial investment possibilities if the swimming pool grows. Firms increasing funds may take advantage of a broadened recognized financier base to attract from.

Innovative Real Estate Investments For Accredited Investors for Exclusive Opportunities

Those that are presently considered certified financiers have to remain updated on any kind of modifications to the standards and regulations. Their eligibility might be subject to modifications in the future. To keep their condition as recognized capitalists under a changed definition changes may be essential in wide range administration strategies. Businesses looking for accredited financiers ought to remain vigilant about these updates to ensure they are attracting the ideal audience of capitalists.

Table of Contents

- – Exceptional Accredited Investor Platforms for ...

- – Reliable Accredited Investor Opportunities

- – Best-In-Class Exclusive Deals For Accredited ...

- – Exceptional Accredited Investor Wealth-buildi...

- – Five-Star Accredited Investor High Return In...

- – Top Investment Platforms For Accredited Inve...

- – Innovative Real Estate Investments For Accre...

Latest Posts

House For Back Taxes

Tax Lien Investing In Canada

Tax Liens Gov

More

Latest Posts

House For Back Taxes

Tax Lien Investing In Canada

Tax Liens Gov