All Categories

Featured

Table of Contents

- – Value Accredited Investor Secured Investment O...

- – Tailored Accredited Investor Secured Investmen...

- – Exclusive Passive Income For Accredited Inves...

- – Strategic Accredited Investor Financial Growt...

- – Favored Passive Income For Accredited Investors

- – Comprehensive Passive Income For Accredited ...

- – Innovative Private Equity For Accredited Inv...

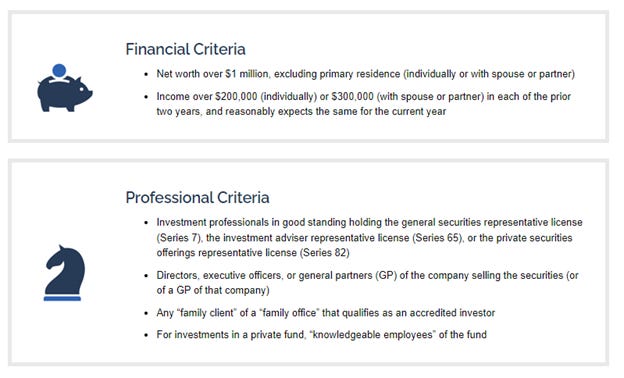

The regulations for accredited investors differ amongst jurisdictions. In the U.S, the meaning of an approved investor is put forth by the SEC in Regulation 501 of Guideline D. To be an accredited capitalist, a person must have a yearly earnings going beyond $200,000 ($300,000 for joint revenue) for the last 2 years with the expectation of making the very same or a greater revenue in the current year.

A certified investor should have a internet well worth surpassing $1 million, either independently or collectively with a spouse. This quantity can not include a key house. The SEC additionally thinks about candidates to be certified financiers if they are basic partners, executive policemans, or supervisors of a business that is releasing unregistered safeties.

Value Accredited Investor Secured Investment Opportunities

Additionally, if an entity includes equity owners who are recognized investors, the entity itself is an accredited financier. An organization can not be developed with the single objective of acquiring details safety and securities. An individual can certify as an approved financier by demonstrating adequate education or work experience in the monetary sector

Individuals who intend to be approved financiers don't apply to the SEC for the classification. Instead, it is the obligation of the business supplying an exclusive positioning to make certain that every one of those come close to are certified financiers. Individuals or parties that wish to be accredited investors can approach the provider of the non listed safety and securities.

For instance, mean there is a private whose revenue was $150,000 for the last 3 years. They reported a primary home worth of $1 million (with a home loan of $200,000), a vehicle worth $100,000 (with a superior finance of $50,000), a 401(k) account with $500,000, and a cost savings account with $450,000.

This person's web well worth is specifically $1 million. Because they satisfy the web worth need, they qualify to be a certified financier.

Tailored Accredited Investor Secured Investment Opportunities

There are a couple of much less typical credentials, such as managing a depend on with even more than $5 million in assets. Under federal securities laws, only those who are approved investors might get involved in specific safety and securities offerings. These may include shares in exclusive positionings, structured items, and personal equity or hedge funds, among others.

The regulatory authorities wish to be certain that individuals in these very risky and complex investments can take care of themselves and judge the threats in the lack of federal government security. The certified capitalist guidelines are designed to protect potential financiers with limited economic expertise from adventures and losses they may be ill outfitted to stand up to.

Approved investors fulfill certifications and specialist standards to accessibility exclusive investment chances. Designated by the United State Stocks and Exchange Commission (SEC), they gain access to high-return choices such as hedge funds, endeavor funding, and private equity. These investments bypass complete SEC enrollment however lug greater dangers. Accredited capitalists must meet earnings and internet worth demands, unlike non-accredited people, and can invest without restrictions.

Exclusive Passive Income For Accredited Investors

Some vital adjustments made in 2020 by the SEC consist of:. Including the Series 7 Collection 65, and Collection 82 licenses or various other credentials that reveal financial competence. This adjustment acknowledges that these entity types are often used for making investments. This modification recognizes the know-how that these workers create.

These amendments expand the accredited financier swimming pool by about 64 million Americans. This broader gain access to provides extra opportunities for capitalists, but also boosts prospective risks as much less monetarily sophisticated, financiers can participate.

These investment options are exclusive to accredited financiers and institutions that qualify as a certified, per SEC guidelines. This provides recognized capitalists the chance to invest in emerging firms at a stage prior to they think about going public.

Strategic Accredited Investor Financial Growth Opportunities for Financial Growth

They are considered as investments and come just, to certified customers. In addition to well-known firms, certified investors can choose to spend in start-ups and promising endeavors. This offers them income tax return and the chance to get in at an earlier phase and potentially gain benefits if the company succeeds.

However, for investors available to the risks involved, backing startups can result in gains. Most of today's technology business such as Facebook, Uber and Airbnb came from as early-stage start-ups sustained by accredited angel investors. Sophisticated investors have the opportunity to check out investment options that may produce a lot more profits than what public markets supply

Favored Passive Income For Accredited Investors

Returns are not guaranteed, diversification and profile improvement options are increased for capitalists. By expanding their profiles through these broadened investment avenues accredited capitalists can improve their approaches and possibly accomplish exceptional long-lasting returns with correct danger administration. Skilled capitalists commonly experience investment choices that may not be conveniently offered to the general investor.

Financial investment choices and safety and securities supplied to recognized investors typically entail higher risks. Exclusive equity, venture capital and hedge funds typically focus on spending in assets that bring threat but can be liquidated conveniently for the possibility of higher returns on those high-risk investments. Investigating prior to spending is crucial these in circumstances.

Secure periods avoid financiers from withdrawing funds for even more months and years on end. There is additionally much much less openness and governing oversight of exclusive funds contrasted to public markets. Investors may have a hard time to properly value private properties. When dealing with dangers accredited financiers require to evaluate any personal financial investments and the fund managers included.

Comprehensive Passive Income For Accredited Investors

This adjustment may expand accredited investor condition to a variety of individuals. Permitting companions in committed connections to incorporate their resources for common qualification as accredited capitalists.

Enabling people with certain expert qualifications, such as Series 7 or CFA, to certify as recognized capitalists. Developing added requirements such as evidence of monetary literacy or efficiently finishing an approved financier test.

On the various other hand, it might additionally lead to knowledgeable financiers thinking excessive dangers that may not appropriate for them. So, safeguards may be needed. Existing recognized capitalists may deal with enhanced competitors for the very best financial investment chances if the swimming pool grows. Firms increasing funds might take advantage of an expanded recognized financier base to attract from.

Innovative Private Equity For Accredited Investors

Those that are presently thought about certified financiers need to stay updated on any kind of changes to the requirements and policies. Services looking for accredited financiers must remain cautious about these updates to guarantee they are attracting the appropriate target market of financiers.

Table of Contents

- – Value Accredited Investor Secured Investment O...

- – Tailored Accredited Investor Secured Investmen...

- – Exclusive Passive Income For Accredited Inves...

- – Strategic Accredited Investor Financial Growt...

- – Favored Passive Income For Accredited Investors

- – Comprehensive Passive Income For Accredited ...

- – Innovative Private Equity For Accredited Inv...

Latest Posts

Tax Sale Overage List Tax Foreclosure Overages

Accredited Individual Investor

Comprehensive Exclusive Investment Platforms For Accredited Investors

More

Latest Posts

Tax Sale Overage List Tax Foreclosure Overages

Accredited Individual Investor

Comprehensive Exclusive Investment Platforms For Accredited Investors